Rewriting Female Funding Narratives

Since the world of venture capital is built by (and is basically for) men, fgc Co-founder & CEO of Moody month, Amy thomson shares her experiences and provides advice on what female founders and startups can do to get capital on their terms (#byebyemalebias) and introduce new people to investment helping to make the investment community more representative.

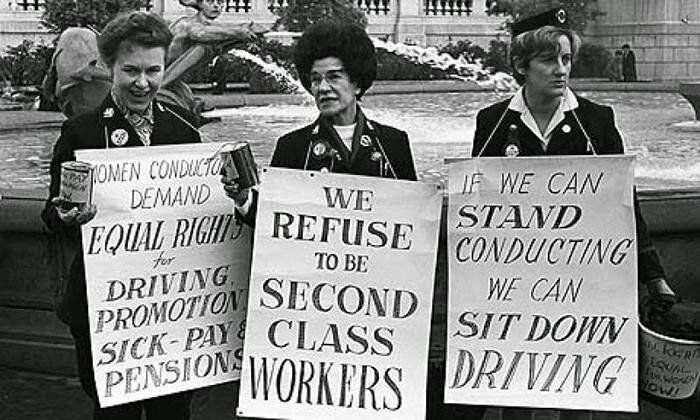

The gender disparity in start-up funding is not new news.

Although the conversation has resonated in the media, the 2% of VC investment in female founders has not improved, with even less invested in racial minorities.

I am frustrated by the idea that there is a right or wrong way to do funding. The idea that ‘good signalling’ from your funding journey is paramount to success is dangerous for female founders as it simply doesn’t take into account the barriers to entry they are facing. This is why we need to encourage a bottom-up approach, shifting the dynamic from VC’s holding all the cards to solving this problem collectively and empowering founders to look outside the VC route for funding opportunities. This is also why we are crowdfunding as a business. The VC industry shouldn’t be solely responsible for addressing this diversity challenge, it’s time for women to rewrite the funding narrative.

I will start by outlining the global social and economic issue at the heart of this problem, then explore the other challenges affecting investment in women. The bias that is afflicting women is mostly sub-conscious, part of a western culture where men were the ‘breadwinners’ and women were the ‘homemakers’. It can take centuries to change social cycles and US women were only granted access to bank lending in 1974. The existence of funding mechanisms almost exclusively for white men, sadly isn’t a huge surprise. People fund things and people familiar to them. In psychology this ‘familiarity’ bias is called fundamental attribution error and is one reason cycles of inequality perpetuate subconsciously, simply through the lack of diversity in decision making. This article is not about attributing blame, but providing an honest account from my experience of the funding landscape for female founders, with the hope that, by driving change, female founders can achieve equal representation.

check Moody Month’s Crowdfunding page

The Social Landscape:

Women are still conducting 75% of unpaid care and domestic labour, including up to 3 hours more daily housework and 10 times longer caring for children and the elderly. Starting a business as a female founder inherently involves more risk, as women have less time available. Women must be either financially secure (with childcare) or have no dependents or responsibility at all. For women who push past the barriers and do gain access to this elite set of female founders, huge social challenges still await, as women are perceived as creative and emotional, not strategic and commercial.

In this HBR article about challenges facing women in fundraising, communication bias is highlighted as a barrier. Media language data demonstrates that female founders are represented either as a female or girl boss, with male founders being just a boss. This gendered language, by setting women up as an anomaly, also perpetuates the idea of higher risk or of an emotional leader with less commercial viability. This is highlighted in the language used by funders when interrogating female vs male founders.

HBR found that 67% of questions posed to male founders were focused on their growth aspirations, whereas 66% of female founders were asked how they would defend a position, male bias assuming that men will fight to grow, while women will need to defend growth. Ironically, men are more often defending market opportunities due to saturation in male-dominated markets, whilst female founders often pursue underserved, high-growth markets.

The answer to this gender bias is simply funding more women, but as we’ve seen the problem isn’t the simple maths, it’s the emotion of risk and low propensity of people to see past their own experiences. Men are mostly trying to help solve this inequality problem too, but cannot themselves drive the shift required. Just take Elvie — the digital breast pump, now with multi-million $ turnover. The founder, Tania Boler, was told this brand and product was niche, as that is what men who heard her pitch believed. They weren’t saying it to be mean, they just hadn’t lived the experience and wouldn’t be a customer. Economics is just as biased as any other system. These female underserved and ignored sectors will serve women well in this new era of opportunity. However, the funding still isn’t aligning, so we need to think outside the box. The market components are there, we just need to mobilise them.

Most of the above is not new news, but what it highlights is that the perception of women being ‘riskier’ investments is simply subconscious. VC’s have the right intention, but not the right perspective or lived experience to change the system, as only 10% of partners are women. How can we change the landscape?

The Funding Landscape:

The funding narrative, especially in tech, is focused on VC. This is what we have been told historically through media coverage of previous success stories. Some of the biggest business in the world have been VC funded, from Facebook and Google to Apple, but on this traditional path, both funder and founder are almost exclusively white men. The simple VC principle is to invest in scalable business and make a 10x return on their investments and x3 return on their fund. VC’s are tasked with finding founders with great ideas and assessing the risk and reward to deliver high yield cash exits, often taking large equity stakes due to the risk involved and investing early to take advantage of the business’s growth over time (roughly ten year cycles). This works in theory, early stage business gets money to grow and fund pays back their investors ten fold.

The issue here is risk and the emotional bias associated with quantifying it. Risk is often calculated as an absolute value, a list of metrics that is used to evaluate the likelihood this idea and team will be a huge financial success. However in early stage business risk is more qualitative, which is why funds often say they look for exceptional founding teams as a way of qualifying a business’ prospects. Rather than wait for VC’s to become more diverse I want to propose some founder-first ways of breaking the cycle, bottom up, not top down. So what can be done and how can female founders take a proactive role in this narrative?

We must stop trying to play the same game as men and think about how as founders we can rewrite the rules for building a $billion business. By sharing some of my own stories and insight from other female founders who have used ‘non-traditional’ funding methods to build their business, I hope to inspire women at the very least to give their idea a go.

Fundamentally, if you can build revenue proof points and scale as a female founder there is VC investment out there, it is just likely to appear later in a female founder’s growth journey. Tradition has built gender disparity, so it’s illogical to assume that traditional methods would be the route to change.

I am sharing my personal bootstrapping stories as a ‘Seed’ stage business (and would encourage other female founders to do the same), to show as many women as possible that although the social systems are against us, there is still huge opportunity out there if you think creatively.

The first four are cash-in-bank funding methods our business has used and the other three are important ways to ensure you have the profile and voice to succeed in the raise process, as ultimately, money is the most important thing for growth.

YOUR FEMALE-FRIENDLY FORMS OF INVESTMENT

1- Angel investors and networks:

This is Moody’s primary funding route. I have raised £2m in capital from individuals. Angel investment means you have an investor cohort, who believe in you and the business. It’s great to see more women angel investing, leading to improved diversity. The challenge here is access to these networks. However, groups are becoming more interconnected in major cities and post Covid-19, all networks are online with Zoom pitches becoming the norm. Digital pitching helps remove some of the environmental bias that can set women up to fail.

Tips:

Get feedback from everyone on what did and didn’t work and treat every pitch as an opportunity to learn. The more you pitch the tighter you get. It’s like being a news anchor, you need to learn your lines and deliver them.

Numbers game: The more people you can get in front of the higher the chance of conversion. So, treat every angel investor as a route to ten more, aiming for a minimum of two introductions per investor. Encourage them to be an advocate within their network.

Targets: Treat networking like a sales strategy. Set pitch targets each month and then focus on hitting that many pitches, mine was ten per month and then thirty, as my network grew. Avoid LinkedIn, aiming only for warm introductions, through friends or contacts.

Lessons learnt: A large angel investor base requires management. Some investors require clear capital growth targets and monthly updates on performance against targets. I also host quarterly group calls, which solved the issue of being bombarded throughout the month.

2- Crowdfunding:

As a B2C business this enables both public profile and capital raising. However, this has historically been considered ‘bad signalling’ by VC’s. In fact, crowdfunding enables a business to build a more democratic investor base. Especially as a female founded and diverse team, it enables consumers to see how your business operates and differentiates, which for younger audiences influences purchase decision making. So, you build customers and investors. Since 2018 and following incredible crowdfunding stories from B2C businesses like Monzo, the perception is changing, with the focus not on charity, but on the route to revenue and new customers.

Tips:

Which platform: Choose your platform based on what your business needs, there are multiple crowdfund platforms in most territories. Research who has the best network and profile in your territory. We chose Crowdcube, as it had a B2C focus, EU network and best historic PR traction.

Revenue talks: Whilst traditional funding methods may focus on building product and growth over revenue, for Crowdfunding, make sure you have a clear and easy to understand commercial model, as investors will be assessing your business’ ability to make money. This is not a Kickstarter, which is a different, more charitable format.

Content: Video and images talk. Hire someone great to build the content to support the campaign. This will speak volumes about your brand and business.

Raise before you raise: Set a funding goal you can hit pre public-launch, as it is essential you don’t miss your target.

Lesson learnt: Communicate clearly what the motivation for crowdfunding is, which should NOT be needing the money. Your four key audiences will be: 1-Crowdfunding investors, 2- Existing investors 3- existing customers 4- your team. If everyone knows the mission and vision behind this route, you will build advocacy.

3- Behind the scenes revenue:

If you are looking at bridging between rounds, or are just unsure about raising money, build ways you can help other businesses succeed or learn from your growth or audience insight. For example, we have built a huge audience of women focused on wellness, which solidified our position as experts in the space. Helping brands understand how to talk to millennial women enabled us to bring capital into the business, that although not part of our core business model, was an effective way to subsidise operating costs.

Tips:

Promote yourself as a CEO and consultant- The leader of a business may also be able to build in complementary expert roles, developing both your own career and your business, which is important as not all businesses will succeed. Knowing that the business is always fuelling my personal development as a founder has been key for me.

Not for everyone: This can be time consuming and if you are tight on time in the earliest stages of business growth, be careful not to over commit. This method worked for me but is not for everyone.

4- Tax credits and government grants

The start-up economy is seen as a huge opportunity for GDP, so almost every government now has grants designed for start-ups. Nevertheless, many women I speak to don’t consider tax breaks as something they are comfortable applying for, evidencing further economic and system bias. I would encourage every female founder to become a tax and benefits expert, or employ a tax consultant to ensure they have all entitled credits built into financial planning. It could be the difference between going from £500k investment to £1m. Grants are often more complicated, as they have rigorous application processes, but there are companies out there who can do the heavy lifting for a fee. Take advantage of these opportunities, as they are designed to help you succeed.

Tips:

Hire experts: Bring in the right experts for your location, researching on google or through recommendations from other founders. Support in these areas will likely become cost neutral to you, if you can secure the funds.

Control costs and fees: Hire people for flat fees or % of grant return, limiting capital risk and ensuring the money received helps grow your business.

These final three points will help extend your reach and runway, without overextending yourself.

5- Equity terms

Equity terms for founding staff help control salary spend but also ensure long-term payback for staff who stay with you. In truth these conversations can be hard, as equity only holds value if the business is a success and conversely you should avoid giving away too much too early. Get as much free and or paid advice as possible.

6- Books and opinion pieces- Draw on expertise within your industry to write articles. You may not be the top doctor or technologist in your field, but you should master your craft through any means possible. This involves sharing research and opinions through Medium or publishing. You can hire people to write content, if it’s not your strong suit. Even as a B2B business, a clear understanding of the landscape will help you build a better product and business.

7- Self-belief and emotional health

Sounds cliché, but running a business and affecting change is a marathon not a sprint, with business cycles averaging 10 years. It takes time, energy and focus to build a company, especially when navigating without a funding rule book. However, giving yourself permission to self-care as part of your mental and physical health training will help you achieve your goals.

A huge caveat to this is not everyone should be a founder. But we can all support more diverse and inclusive founding teams, as founders and as customers of these products and services. You can also support our crowdfund and those of other diverse founders. The central goal for most of us is to build a more equal world. Being part of a community of people building business as a ‘minority’ is one contribution to re-writing the rules. Anyone that tells you there is one method or acceptable way to raise money or build a business, simply isn’t aware of the world we live in and is more part of the perpetuation of bad habits that have got us into this unequal place.